Solution Manual Capital Budgeting Cash Flow

11 -1 Onl y cash can be spen t or rei nve st ed, an d si nc e ac co unt ing pr ofi ts do not represent cash, they are of less fundamental importance than cash flow s for inve stme nt anal ysis. Rec all tha t in the stoc k valua tio n chap ter we focu sed on divi dend s, whic h repr ese nt cash flows, rat her than on earnings per share. 11 -2 Cap it al budg et in g an aly sis sho ul d on ly incl ude tho se cash flow s th at will be af fect ed by the dec isio n. Sunk co sts are un reco vera ble and cann ot be change d, so they have no bear ing on the capita l budg etin g decision. Opportunity costs represent the cash flows the firm gives up by investing in this project rather than its next best alternat ive, and externalities are the cash flows (both positive and negative) to other projects that resu lt from the firm taking o n this p roject.

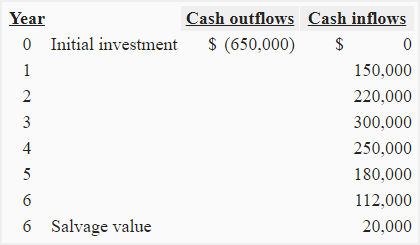

These ca sh fl ow s oc cu r on ly be ca us e th e fi rm to ok on th e ca pi ta l bu dg et in g project; therefore, they must be included in the analysis. 11- 3 When a f irm ta kes on a n ew cap ital b udge ting p roje ct, it t ypic ally m ust increase its investment in receivables and inventories, over and above th e in cr ea se in pa ya bl es an d ac cr ua ls, th us in cr ea si ng it s ne t operatin g working capital (NOWC). Since this increas e must be finance d, it is inc luded as an outflo w in Year 0 of the a nalysis. At the e nd of the pro je ct’ s li fe, inv en tor ie s ar e de ple te d and rec ei vab le s ar e collected.

Thus, there is a decrease in NOWC, which is treated as an inflow in the final year of the project’s life. 11 -4 Si mu la ti on an al ys is in vo lv es wo rk in g wi th co nt in uo us pr ob ab il it y d is t r i bu t i o ns, an d t h e o u t pu t o f a s im u l a ti o n a n a l ys i s is a dis tr ibu ti on of net pres ent va lue s or ra te s of ret ur n. Sc ena ri o anal ysis invo lves pick ing seve ral poin ts on the vari ous prob abil ity distributions and determining cash flows or rates of return for these points. Sensitiv ity anal ysis invo lves det ermining the exte nt to whi ch cash flows change, giv en a chan ge in one partic ular input variab le. Simulati on analys is is expen sive.

Budgeting Cash Flow

The Basics of Capital Budgeting Evaluating Cash Flows ANSWERS TO END -OF-CHAPTER QUESTIONS 7-1 a. Capital budgeting is the whole process of analyzing projects and deciding whether they should be included in the capital budget. Cash flow in Year 5 than on a cash flow in Year 1.

Therefo re, it would more than li kely be em pl oy ed in th e de ci si on fo r th e $2 00 mi ll io n in ve st me nt in a satellite system than in the decision for the $12,000 truck.